Why aren't regulators getting any blowback for this banking collapse of 2023?

Silicon Valley Bank and Signature Bank failures could've been mitigated

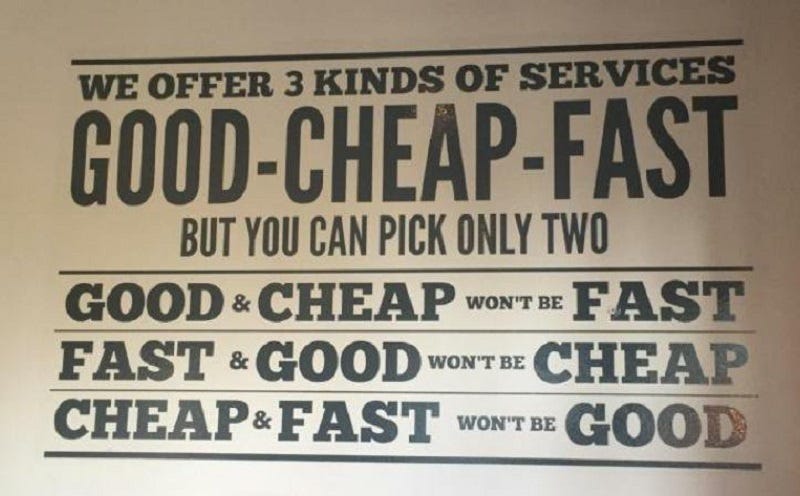

With 20 years in the banking industry and in regulatory compliance my interactions with banks and regulators have been tested. Bankers will do push the limits (who wouldn’t) but will ultimately comply. Regulators come have their own Fed-like dual mandate of high quality exams but fast because there’s not enough of us to do all the banks. In particular, the bank collapses of 2023 and the inflation issues that followed were, in large part, the result of regulators failing to properly examine banks and identify potential problems before they spiraled out of control.

The Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) are two of the most important regulators in the US financial system. The FDIC, in particular, is responsible for insuring bank deposits and maintaining stability in the banking sector, while the OCC is tasked with supervising national banks and ensuring that they comply with federal regulations. Together, these agencies play a critical role in safeguarding the US financial system, and their failures can have far-reaching consequences.

In the case of the bank collapse of 2023, it appears that both the FDIC and OCC failed to properly examine the banks in question and identify the risks they posed to the wider financial system. As a result, when these banks began to experience financial difficulties, there was no one in a position to take decisive action and prevent the situation from spiraling out of control. This led to a cascading series of failures that ultimately resulted in the collapse of several major financial institutions and a widespread loss of confidence in the banking system as a whole.

One of the key issues that contributed to the regulators' failure in this case was a lack of resources and expertise. The financial system has become increasingly complex and opaque in recent years, making it difficult for regulators to keep up with the latest developments and identify potential risks. Additionally, budget cuts and other constraints have made it difficult for the FDIC and OCC to attract and retain the talent needed to effectively oversee the banking sector.

Another problem was a lack of coordination between different regulatory agencies. In many cases, different agencies may have overlapping responsibilities or different approaches to risk management, making it difficult to effectively identify and manage potential risks. This was certainly the case in the bank collapse of 2023, where it appears that different regulatory agencies failed to communicate effectively with one another and coordinate their efforts.

Finally, there may have been political pressure on regulators to take a more lenient approach to bank oversight in the years leading up to the crisis. In an era of deregulation and pro-business policies, there may have been a reluctance to impose strict rules and regulations on banks, even when doing so might have been in the best interests of the wider economy.

In conclusion, the bank collapse of 2023 and the resulting inflation issues were a stark reminder of the importance of effective financial regulation. While regulators such as the FDIC and OCC play a critical role in safeguarding the financial system, they are not infallible, and their failures can have far-reaching consequences. To prevent similar crises from occurring in the future, it will be essential for regulators to be adequately funded and staffed, to coordinate effectively with one another, and to resist political pressure to take a lax approach to bank oversight. Only then can we ensure the stability and security of our financial system for years to come.